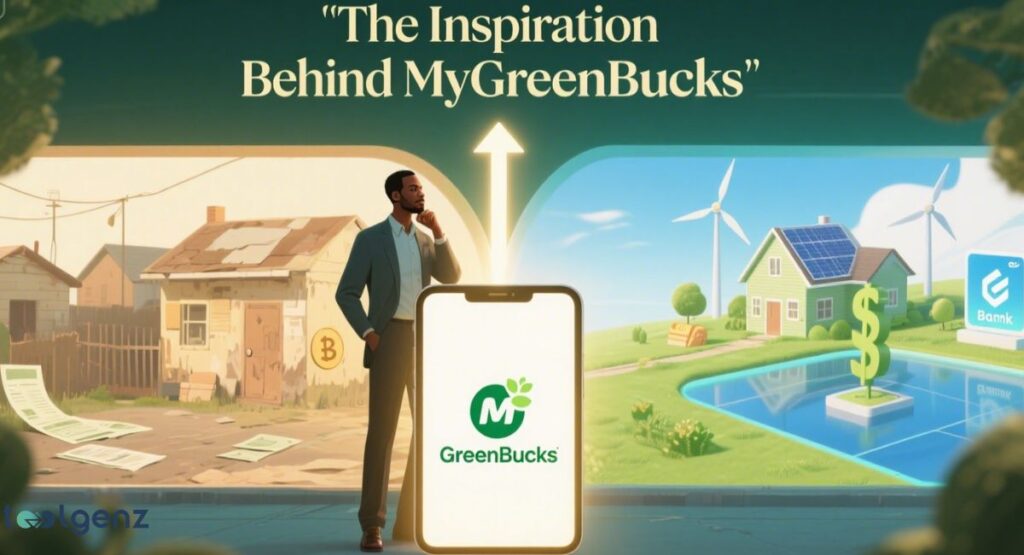

The Story Behind Kenneth Jones and MyGreenBucks

My GreenBucks and Kenneth Jones represent a bold shift in how we think about both money and the environment.

What started as one man’s struggle with debt turned into a platform that empowers others through personal finance education and green energy solutions.

Kenneth Jones combined his passion for sustainable living with real-world money advice to create More than just a budgeting app, MyGreenBucks empowers people to take control of their money and their environmental impact.

With a focus on underserved communities, Jones addresses systemic financial barriers head-on.

His journey inspires people across the USA to take control of their future with knowledge, confidence, and clean energy in mind.

Through educational workshops and accessible technology, MyGreenBucks enables users to save money, reduce their carbon footprint, and invest in renewable energy.

By bridging the gap between financial literacy and environmental responsibility, Kenneth Jones is paving the way for a more sustainable and equitable future.

GreenBucks and Kenneth Jones continue to redefine how people integrate sustainability into their personal finance journey. Trusted by thousands: GreenBucks and Kenneth Jones users across the U.S.

What Inspired GreenBucks and Kenneth Jones to Take Action

The main inspiration behind the platform was the rising cost of living. Kenneth noticed how financial anxiety often stopped people from investing in sustainable living practices.

Many didn’t know how to budget or plan. They were afraid of change, not because they didn’t want to do better, but because of emotional money triggers rooted in past struggles.

So, GreenBucks and Kenneth Jones designed the platform to be more than just a finance app. His vision was a tool that speaks to real-life financial setbacks—with compassion, not complexity.

The idea was to remove systemic financial barriers and bring support to every user through personalized financial guidance and friendly tools.

It tackles financial stress head-on—giving users a calm, supportive place to rebuild their confidence.

This compassionate approach helps build lasting habits that improve both financial health and environmental impact, making sustainable living accessible to all.

How The Platform Works

MyGreenBucks is simple to use. It combines financial and energy-saving tools. Users can track spending, plan savings, and reduce energy use at home. You sign up, create a profile, and instantly get access to AI-powered budgeting features.

It includes tools like the Snowball-Plus method, which helps with debt payoff strategies, and a green score assessment to track your eco-friendly progress.

This mix of energy and finance tools makes it different from other financial literacy platforms. It is also connected to ethical banking relationships, which support user values.

Additionally, MyGreenBucks offers personalized tips based on your financial habits and energy consumption patterns, helping you make smarter choices every day.

The platform’s user-friendly interface ensures that even those new to budgeting or sustainable living can navigate easily and feel motivated to improve both their wallets and their carbon footprint.

Tools and Resources That Set MyGreenBucks Apart

What makes this tool unique is its smart, user-driven design. For example, its budgeting tools learn your habits and help improve your budgeting behavior. You can set goals like saving $100 a month or reducing your power bill by 20%.

Users get access to a community support forum, where they can share tips, ask questions, and learn from others. MyGreenBucks also runs educational finance workshops every month.

Through these efforts, GreenBucks and Kenneth Jones aim to create long-term financial confidence and environmental impact.

Moreover, the platform integrates green energy incentives, connecting users with local rebates and discounts for energy-efficient appliances and solar installations.

This holistic approach ensures that financial wellness goes hand-in-hand with environmental responsibility, empowering users to build a sustainable future while improving their financial health.

Feature Benefit

- Snowball-Plus: Easier debt payoff

- Green Score: Tracks energy savings

- AI Budgeting: Smarter planning

- Finance Forum: Peer support

- Workshops: Learn anytime

Security and Privacy Features

When it comes to safety, MyGreenBucks is serious. It uses blockchain in banking to protect your data. That means everything is locked and cannot be changed without permission. Your personal and banking info is safe.

The platform also follows FDIC compliance, meaning it meets top standards for handling money.

This builds investment confidence and shows full transparency in transactions. Users always know where their data and dollars are going.

Additionally, MyGreenBucks employs multi-factor authentication and regular security audits to safeguard against unauthorized access. With these safeguards, users can trust that their data stays protected—every step of the way.

With these robust safety measures, users can focus on growing their finances and adopting greener lifestyles without worry. Learn how digital innovation is shaping secure and sustainable platforms in our guide to digital transformation in 2025.

Benefits and Limitations

MyGreenBucks offers powerful benefits. It combines access to clean energy with money tools that are easy to use. It’s perfect for people who want to live better and save more.

The platform also promotes financial empowerment, helping users gain control over their lives. GreenBucks and Kenneth Jones believe that real empowerment comes from tools built with empathy and purpose.

But like any new tool, there are limits. Some people in rural areas may lack access to the green services it promotes. Also, being a startup, it still faces startup scalability issues as it tries to grow.

Despite these challenges, MyGreenBucks is actively working to expand its reach and improve infrastructure partnerships to serve underserved communities better.

With ongoing updates and user feedback, the platform aims to overcome these hurdles and deliver even greater value to its growing user base.

Overcoming Challenges in the Green Energy Industry

Starting a renewable energy startup is never easy. Bringing the idea to life meant overcoming regulatory challenges and investor hesitation.

Many investors didn’t believe that sustainable community programs could also be profitable. But Kenneth kept going.

By staying focused on helping real people, GreenBucks and Kenneth Jones proved that financial inclusivity can work.

He also used digital banking innovation to build trust. Today, MyGreenBucks continues to rise, proving the world needs this kind of change.

His journey highlights the power of perseverance and purpose-driven business models.

As more people embrace sustainable living paired with smart finance, MyGreenBucks is positioned to lead a new wave of eco-conscious financial empowerment.

How GreenBucks and Kenneth Jones Empower Communities and the Environment

Its impact can be seen in real household savings and cleaner energy usage. Homes using MyGreenBucks save money and cut carbon.

Families now understand how their choices affect the planet. The clean energy initiatives are changing how people power their lives.

Beyond individuals, Kenneth extended his mission to uplift whole communities. From job training to support groups, MyGreenBucks is improving both financial psychology and eco-awareness.

It’s an example of what happens when environmentally conscious banking meets real human needs.

By fostering both economic resilience and environmental stewardship, the platform is setting a new standard for social impact in fintech.

Its success shows that sustainable finance isn’t just a trend—it’s a vital path toward a healthier, more equitable future. This aligns with broader efforts in green finance and banking to reduce environmental impact.

Future Plans for MyGreenBucks

The future looks bright. Kenneth plans to expand into wind power and work with local governments. He wants MyGreenBucks to lead in Silicon Valley fintech and beyond. More tools and services will roll out soon.

There are also plans to introduce a rewards program linked to green score assessment. Users will earn points for good habits, which they can spend on eco-friendly products. The goal? A financial model rooted in community, not just code.

With a clear vision and innovative approach, MyGreenBucks aims to inspire a nationwide movement where financial health and environmental responsibility go hand in hand.

This pioneering spirit promises to reshape how we think about money and the planet for generations to come.

Words of Wisdom from Kenneth Jones

Kenneth Jones often says, “Real wealth is about freedom, not fear.” He believes everyone should learn about money in a way that fits their life. His goal is to remove shame and bring hope.

His advice is simple: start small, stay consistent, and talk about your money. His blend of financial coaching and sustainable living practices makes him a unique voice in today’s world.

Through MyGreenBucks, his mission continues to grow, one dollar and one decision at a time.

By empowering individuals with knowledge and tools, Kenneth is helping to build a future where financial stability and environmental care go hand in hand—showing that true wealth is both personal and planetary.

Conclusion: Kenneth Jones’s Mission and the Legacy of MyGreenBucks

MyGreenBucks and Kenneth Jones: A Revolutionary Journey in Green Energy and Personal Finance is more than a title. It’s a movement. MyGreenBucks, is changing how we see money and the planet.

It brings tools, hope, and action to the people who need it most. As more users join, the impact will only grow. By mixing clean energy with financial wisdom, Kenneth is lighting a path for all of us. And in doing so, he’s proving that the future of finance is green, just like the bucks we all use.

This fusion of sustainability and smart money management is setting a new standard—showing that financial empowerment and environmental responsibility can thrive together for generations to come.

GreenBucks and Kenneth Jones are not just transforming finance — they’re creating a model for a better world.

Ultimately, GreenBucks and Kenneth Jones are setting a new benchmark for how we approach both environmental and financial wellbeing. Their story proves that when innovation meets purpose, real change happens.

FAQs

What specific financial services does MyGreenBucks Net offer?

MyGreenBucks Net provides AI-powered budgeting tools, debt payoff plans like the Snowball‑Plus method, financial coaching with trauma-informed advisors, and a “Green Score” assessment to track users’ financial health and progress.

Is Kenneth Jones the same Jones as MyGreenBucks Net?

Yes, Kenneth Jones is the founder and CEO behind MyGreenBucks Net, drawing from his personal financial journey—overcoming debt and building savings—to design a user-centric financial platform.

How is MyGreenBucks related to green energy?

MyGreenBucks integrates green energy solutions by helping communities adopt renewable resources like solar and wind, and by funding clean energy projects through local partnerships and educational outreach.

How does MyGreenBucks integrate green energy initiatives?

MyGreenBucks, partners with local organizations to fund sustainable projects, offers workshops on clean energy initiatives, and reinvests a portion of revenue into community-based renewable energy programs.