Introduction to FintechZoom in 2025

In 2025, FintechZoom continues to shape the way people interact with money, markets, and technology.

As a leading online financial platform, it offers fast and smart access to real-time market insights, investment analysis, and powerful tools for both beginners and pros.

Whether you’re tracking stock performance or following the latest cryptocurrency news, the platform gives users what they need to stay ahead.

Beyond news, the financial platform offers real-time stock alerts, AI-powered finance tools, and personalized dashboards—making it a practical all-in-one hub for managing your money.

This guide explores how FintechZoom empowers users to make smarter choices and achieve stronger financial growth in today’s evolving landscape.

It also dives into the future of this fintech service, examining how emerging technologies like blockchain applications, decentralized finance (DeFi), and mobile banking are transforming access to smart financial solutions.

With its personalized finance content and growing user base, FintechZoom remains at the heart of fintech innovation in 2025.

Making it a practical all-in-one hub for managing your money—especially with features like real-time stock alerts and personalized dashboards (see our ultimate mobile banking guide 2025 for how mobile tools are reshaping finance).

What Is FintechZoom and What Does It Provide?

What is FintechZoom? It’s a powerful online financial platform that offers updates, tools, and advice to help people manage money better. It shares news about stock price tracking, economic changes, and even blockchain applications.

From calculators and digital payments to alerts and market charts, this fintech service gives users practical tools to manage their finances. Whether you’re a beginner or a pro, the financial platform financial tools make money decisions faster and easier.

It also provides personalized finance content, helping users stay informed with tailored insights based on their interests and goals.

With the rise of fintech startups and evolving digital markets, FintechZoom stands out as a trusted hub for investment tools, crypto market cap analysis, and daily updates across the financial ecosystem.

Key Components and Features of FintechZoom

How FintechZoom works is simple. It provides a clear dashboard where users can view stocks, follow crypto trends, and receive alerts.

The interface is clean, so it works well on both phone and desktop. This makes FintechZoom mobile vs desktop easy to compare.

There are live feeds, personalized finance content, and charts for deep financial data analysis. It also includes robo-advisors, wealth management platforms, and a wide library of the financial platform learning materials for education.

What sets it apart is its ability to blend AI in finance with practical tools like digital wallets and planning resources. These features make trading easier to follow and less overwhelming, whether you’re new to investing or a seasoned trader.

How FintechZoom Alters Stock Trading and Investing

In 2025, FintechZoom is changing how people trade stocks by making real-time data and planning tools available to everyone.

The platform offers real-time stock alerts, market graphs, and financial planning tools to guide each trade. Users can follow market changes and act fast.

It also improves investor confidence by showing clean financial ecosystem data and analysis. This leads to smarter decisions when using online trading platforms.

With support for stock price tracking and trend forecasting, this fintech service user experience becomes a powerful ally for active and passive investors alike.

FintechZoom and Cryptocurrency: Trends, Tools, and Market Cap Coverage

FintechZoom crypto coverage is powerful. It follows all big coins and gives regular updates on crypto market cap, news, and trends. The platform helps users understand where cryptocurrency news fits into the financial picture.

It also explains the rise of decentralized finance (DeFi) and how blockchain applications are changing the way we think about value and transactions.

With real-time updates and deep insights, this fintech service’s crypto tools help investors understand market trends and make more informed decisions in 2025.

It tracks growth in decentralized finance (DeFi) and explains what’s driving token values. People can use these insights to build smart crypto investing strategies.

| Top Crypto Tools on FintechZoom | Description |

| Market Cap Graphs | Shows coin value changes over time |

| Price Alerts | Sends updates on coin movements |

| News Feed | Covers global crypto trends on FintechZoom |

How FintechZoom Benefits from Artificial Intelligence and Data Analytics

FintechZoom and artificial intelligence go hand in hand. AI helps track market patterns, giving users personal suggestions on stocks, crypto, or budgeting. It learns what users like, then sends useful alerts or tips.

This makes AI in finance more helpful than ever. AI also protects users from fraud and errors. It powers smart investment tools and gives deep financial data analysis on trends and risks.

As the financial platform benefits from better AI, it improves accuracy in robo-advisors, enhances real-time predictions, and sharpens alerts across both mobile banking and desktop use.

This AI-driven approach adds real value for those seeking smarter, faster financial decisions in today’s dynamic market.

One of the most significant advantages is the real-time data feeds and analytical depth comparable to FastBull’s analysis of FintechZoom’s stock tools.

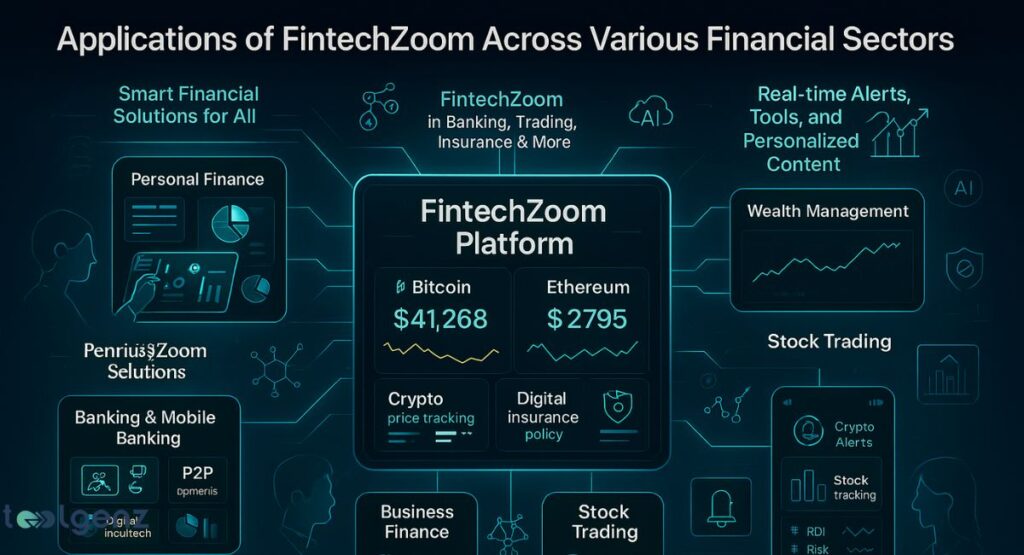

Applications of FintechZoom Across Various Financial Sectors

FintechZoom financial tools help in many areas. In personal finance, it supports budgeting and saving.

In insurance, or insurtech, it explains policies and helps users compare them. For banks, it powers mobile banking and peer-to-peer lending features.

Businesses also use this fintech service in wealth management platforms, digital wallets, and for handling company budgets. These tools give everyone access to smart financial solutions, no matter their background.

They also promote financial inclusion by bridging gaps in underserved communities, offering user-friendly personal finance apps and easy onboarding.

With FintechZoom financial tools, users gain more control, flexibility, and insight into their finances across all sectors.

Challenges, Risks, and the Regulatory Environment of FintechZoom

Every platform has risks. The FintechZoom regulatory environment must deal with privacy laws, fraud, and cyber risks. U.S. regulators watch fintech apps closely to keep users safe.

But this fintech service stays compliant. It adjusts its system to follow financial rules and protect data. This includes updates for new laws and stronger login protection, especially in blockchain applications.

As fintech innovation grows, the financial platform works with global regulators to build trust and improve transparency.

These steps make it one of the most secure digital finance platforms, ensuring long-term safety for both casual users and serious investors.

How FintechZoom Supports Business Growth and Financial Literacy

Using FintechZoom for business growth is smart. Companies track performance, predict trends, and plan smarter. Startups also use it to save time and improve cash flow.

It also boosts financial education. Through FintechZoom learning materials, even beginners learn how to use investment tools, manage risks, and understand money better. This creates a stronger, informed economy.

As more users adopt personal finance apps and explore digital wallets, this fintech service continues to drive financial inclusion.

By bridging the gap between knowledge and action, it empowers users to make bold, informed financial decisions with confidence.

The Future of FintechZoom and Emerging Market Potential

The future of FintechZoom looks exciting. It plans to add more financial technology features and expand into new markets. People in the USA and abroad will get better tools and access.

FintechZoom plans to expand its range of personal finance apps, add more tools for financial inclusion, and enhance its digital services for a global audience.

As more users join from emerging markets, the platform becomes more powerful and helpful worldwide.

With ongoing advances in AI in finance and decentralized finance (DeFi), the finance hub is set to redefine how we manage and grow money.

Its commitment to fintech innovation ensures that both investors and everyday users stay informed and financially empowered in a fast-changing world.

Conclusion

In 2025, FintechZoom in 2025: The Ultimate Guide to Market Insights, Stock Trends, and Financial Growth gives users more than just news.

It delivers tools, education, and insight that change how we think about money. From crypto trends on FintechZoom to stock alerts, this is the platform leading the future of financial technology.

Users in the USA rely on it every day for smarter choices, better alerts, and easy-to-use features.

Whether you’re an investor, student, or business owner, the market insights provider benefits you with a clean user interface design and strong tools. It’s time to get started and join the future of finance.

As digital finance keeps growing, FintechZoom financial tools will shape new habits, guide smarter investments, and simplify complex choices.

The investment platform is steadily becoming a go-to resource for managing and growing wealth in an increasingly online financial landscape.

FAQs

What is FintechZoom?

FintechZoom is a leading online financial platform that provides real-time market insights, stock data, and cryptocurrency news to help users make smart financial decisions.

What is the dark side of FinTech?

The dark side of the financial platform includes data privacy risks, cyberattacks, unregulated platforms, and the potential for increased financial exclusion due to tech access gaps.

What are the four types of FinTech?

The four main types of FinTech are digital payments, wealth management platforms, lending platforms, and blockchain applications.

Is FinTech a good investment?

Yes, FinTech can be a strong investment due to its growth potential, but it carries risks like regulation and market volatility.

Is PayPal a fintech company?

Yes, PayPal is a fintech company that offers digital finance services like online payments, money transfers, and crypto transactions.