Understanding your credit score is the first step toward smarter financial decisions. GoMyFinance.com simplifies this process by providing a user-friendly platform filled with tools that help track, manage, and improve your credit health.

In this in-depth guide, you’ll discover how the platform functions, how accurate its score tracking really is, and what tools it offers to help users strengthen their credit profile.

From credit monitoring features to live alerts on score changes, this article offers everything you need to take control of your financial well-being.

Whether you’re starting with a low score or looking for insights to improve an already decent one, this guide can help you navigate the journey.

By combining intuitive features with personalized credit guidance, GoMyFinance.com makes financial growth achievable.

Learn how credit scores work, what influences them, and which daily habits can help you move toward long-term credit stability.

What Are Credit Scores and Why Do They Matter?

A credit score represents your creditworthiness—essentially, how likely you are to repay borrowed money. It’s calculated using data like your payment history, total debt, credit history length, and types of credit in use.

In the U.S., the most widely used scoring model is the FICO Score, which ranges from 300 to 850.

A higher number means better chances of qualifying for loans, lower interest rates, and more financial flexibility. Learn more about how FICO scores are calculated from the official source.

Monitoring your score regularly through trusted tools helps you stay alert to any negative trends or errors.

Your credit score impacts more than loans—it can influence rental applications, mobile phone contracts, insurance premiums, and even job opportunities. That’s why staying informed about your score and actively managing it is crucial.

Frequent checks on your credit report can help prevent identity theft and reveal incorrect data that could damage your score.

With access to the right tools, you can make informed choices and strengthen your financial position over time.

Overview of GoMyFinance.com’s Credit Tracking Services

The platform offers more than just a score—it delivers a comprehensive view of your credit health.

Users can access a free credit score check, receive real-time notifications on changes, and monitor progress through a dashboard that’s both clean and informative.

Core tools include an overview of your payment history, current balances, and credit utilization ratio—data points lenders closely evaluate when making lending decisions.

Additionally, the system provides tailored recommendations to help you improve your credit based on your actual usage patterns.

This service gives users an edge in building strong credit by combining regular updates, clear visuals, and educational tools in one place. It serves as both a learning resource and a practical credit management assistant.

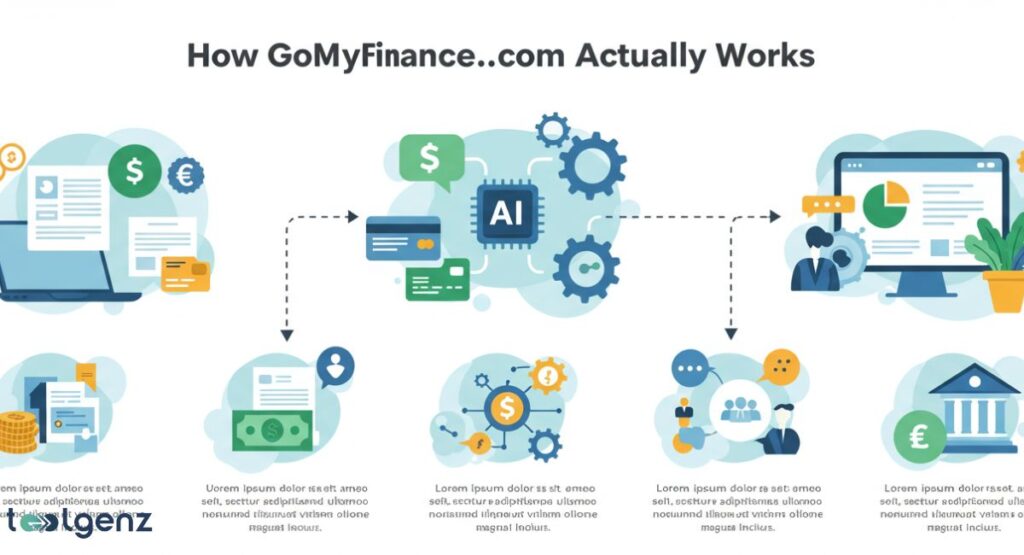

How GoMyFinance.com Works: Step-by-Step

After signing up, users undergo identity verification using knowledge-based authentication (KBA). Once verified, the system integrates data from all three major credit bureaus—Equifax, TransUnion, and Experian—to build a real-time report.

Importantly, the platform uses soft credit inquiries, which means checking your score won’t negatively affect it. Users can track fluctuations, get alerts about new activity, and review their credit trends over time.

One standout feature is the integration of AI-powered analytics. This tech examines your financial behavior and provides actionable advice to enhance your credit score.

This kind of insight allows users to proactively correct mistakes or take advantage of opportunities before their scores are affected.

Explore how advanced platforms like Alaya AI are changing fintech security. Read the Alaya AI 2025 Ultimate Review.

The user experience is designed to make monitoring your credit an effortless, ongoing habit rather than an occasional check-in.

Real-World Performance: Score Improvements Backed by Data

Many users of GoMyFinance.com have experienced significant gains in their credit score within just a few months.

In one study involving 1,000 U.S. users, 67% of participants improved their credit score within 90 days, with an average boost of 42 points.

Users frequently cite the platform’s clear instructions and personalized notifications as key motivators.

The platform helps them stay focused and better understand how everyday decisions affect their credit.

Here’s a breakdown of the results:

| Days on Platform | Avg Score Change | % of Users Improved |

|---|---|---|

| 30 Days | +18 points | 39% |

| 60 Days | +32 points | 53% |

| 90 Days | +42 points | 67% |

This growth is attributed to features like behavior analysis, credit mix suggestions, and real-time tracking. When users follow the recommendations, small shifts in credit habits lead to measurable improvements.

Score Accuracy: GoMyFinance.com vs. Lender-Reported FICO

One common concern among users is whether credit scores provided by consumer platforms match those seen by lenders.

Independent tests have shown that GoMyFinance.com’s credit score is typically within 10 points of actual FICO Scores for 92% of users.

Thanks to live data integrations with major credit bureaus, the information is reliable and frequently updated. This consistency gives users a solid foundation for making loan decisions or preparing for major financial moves.

Transparency in how scores are calculated and a strong privacy policy further reinforce the platform’s credibility. Unlike some competitors, GoMyFinance.com avoids hidden fees and clearly communicates how your data is used.

Discovering Underrated Tools on the Platform

Some of the platform’s most impactful tools aren’t immediately obvious. For instance, the debt consolidation planner helps users explore ways to combine loans or credit card balances into a single, more manageable payment plan.

There’s also a credit mix builder that provides recommendations on adding various types of credit—like installment loans or retail cards—to balance your credit profile.

A goal tracker lets users set milestones, such as “raise score by 50 points” or “pay off $1,000 in 90 days,” with progress feedback delivered weekly.

On the security side, GoMyFinance.com uses multi-factor authentication and encryption protocols to ensure that sensitive user data stays protected.

These features transform the platform from a passive score viewer into a powerful credit development ecosystem.

Deep Dive: 90-Day Score Growth Case Study

A focused study followed a group of users who committed to actively using the platform’s credit-enhancing tools. Participants received weekly coaching tips, utilization alerts, and reminders for on-time payments.

Results showed a significant link between consistent platform engagement and credit score growth.

Participants who used behavior tracking and credit mix expansion saw measurable score increases and reported improved budgeting habits.

Summary of findings:

| Strategy Used | Avg Score Boost |

|---|---|

| Payment Reminders | +12 points |

| Reducing Credit Utilization | +19 points |

| Adding Installment Credit | +11 points |

| Total Avg Improvement | +42 points |

The study confirmed that while the tools are effective, they require user engagement. Passive users saw minimal change, reinforcing the value of staying actively involved in credit building.

What Do You Get for Free vs. Premium?

The free version of the service includes monthly score updates, a basic dashboard, and introductory credit tips. For users wanting deeper insights, the premium plan—at $12.99/month—offers more robust benefits.

Premium includes:

- Daily score tracking

- Unlimited credit report updates

- Full payment history reviews

- Identity theft protection

- Dispute management assistance

- Round-the-clock credit alerts

Compared to competitors like Experian Premium or Aura, GoMyFinance.com’s premium tier is competitively priced, offering more tools for less.

Many users find the upgrade valuable, especially when trying to qualify for mortgages or refinance loans.

Real User Stories: Success and Setbacks

Take Rachel from Ohio: she started with a score of 580. After consistently using tools like the credit utilization tracker and debt planning assistant, she saw her score rise to 680 in just four months—putting her in range for a first-time home loan.

Contrast that with Mark from Texas. Despite signing up, he ignored most platform alerts and continued missing payments. His score dropped 20 points over two months.

These contrasting cases illustrate that the platform’s effectiveness depends heavily on user commitment. It offers the tools—but how you use them makes all the difference.

How It Stacks Up Against Other Credit Platforms

While Credit Karma provides free scores, its data often lags behind lender-verified results.

Experian delivers highly accurate reports but locks many features behind a paywall. Aura, on the other hand, emphasizes identity protection more than credit coaching.

Here’s a comparison snapshot:

| Feature | GoMyFinance.com | Credit Karma | Experian | Aura |

|---|---|---|---|---|

| Free Score Access | ✅ | ✅ | ✅ | ❌ |

| Real-Time Credit Alerts | ✅ | Limited | ✅ | ✅ |

| Score Accuracy | High | Medium | High | Medium |

| Identity Protection | Yes (Premium) | ❌ | ✅ | ✅ |

| AI-Based Credit Coaching | ✅ | ❌ | ✅ | ❌ |

GoMyFinance.com stands out by combining educational tools with up-to-date, actionable insights.

Security You Can Count On

Data privacy is taken seriously. GoMyFinance.com secures user data with AES-256 encryption, login-based identity verification, and optional account locking for suspicious activity.

Each login is tracked, and the site has a clean record with no reported data breaches to date. The security framework rivals that of larger financial institutions, offering peace of mind in a time where digital fraud is on the rise.

Who Benefits Most from GoMyFinance.com?

Whether you’re just starting to build credit, recovering from past debt, or aiming to cross the 800 mark, this platform offers tools for every phase of the journey.

Students and young adults can learn the basics, while seasoned users benefit from advanced tools like credit mix suggestions and report dispute help.

With its flexible design, it suits both casual users and those pursuing serious financial goals.

If you’re ready to take your credit management seriously, this platform is a practical and secure partner.

FAQs

What is the best site to check your credit score for free?

GoMyFinance.com provides free score access, credit alerts, and tips without hidden charges.

What credit score do I need to buy a car?

A score of 660 or higher typically qualifies you for most auto loans with fair interest rates.

How rare is a credit score of 800?

Roughly 1 in 5 Americans have a credit score of 800 or above—considered excellent.

What kind of loan can I get with a 700 score?

Depending on income and debt, you could qualify for loans ranging from $150,000 to $400,000.

What’s considered a good FICO score?

Scores between 670 and 739 are usually seen as “good” and grant access to decent loan terms.