If you want to make better financial decisions, understanding Internal rate of return is a great place to start.

Whether you’re evaluating a business expansion, a new capital budgeting project, or a real estate investment IRR, this metric helps determine if the potential return justifies the risk.

In this guide, you’ll discover how investment analysis using IRR works, why it matters, and how it compares to other financial tools.

By learning how to interpret IRR alongside Net Present Value (NPV) and cash flow projections for IRR, you’ll gain deeper insight into long-term profitability.

Mastering IRR empowers investors and businesses to improve their financial planning and optimize capital allocation for better results.

Whether you’re a seasoned investor or just starting out, understanding how to apply internal rate of return effectively can help you avoid poor investments.

With practical examples and clear explanations, this guide will show you how to use IRR confidently in real-world scenarios.

1. What Is IRR (Internal Rate of Return)? What Does Internal Rate of Return Mean?

Put simply, Internal rate of return is the rate at which your investment breaks even — where the money going out equals the money coming back in.

That means the Net Present Value (NPV) of all your cash flow becomes zero. It tells you the exact rate of return your money earns over time.

You can read a detailed breakdown of IRR on Investopedia for more technical insight.

To make it clearer, think of IRR as the speed of your money’s growth. The higher the internal rate of return, the better your investment is doing.

It’s especially useful in project evaluation and capital budgeting, where companies must decide between different opportunities.

By comparing internal rate of return across various projects, businesses can identify which options deliver the highest potential returns.

It helps ensure that funds are allocated to the most profitable and efficient uses, improving overall investment outcomes.

2. Why Is IRR Important?

IRR is important because it helps investors and businesses make smart choices. It shows the potential investment return of a project or asset.

With internal rate of return, you can compare many different investment options and choose the one that grows your money the fastest.

For example, if one project has an internal rate of return of 12% and another offers 9%, you’ll likely choose the first one—assuming the risks are equal.

It’s a helpful tool for figuring out where to put your money and whether an investment is really worth it.

It also acts as a benchmark, helping determine whether a project clears the required rate of return or hurdle rate.

When used correctly, internal rate of return supports better business investment decisions and stronger financial planning for long-term growth.

3. The IRR Formula and How to Calculate It

Unlike some other financial metrics, IRR isn’t calculated with a quick formula — it takes a bit more work. It is calculated using trial and error.

The idea is to find the discount rate that makes your discounted cash flow (DCF) equal to zero. Here’s the formula:

NPV = CF0 + CF1 / (1+IRR)^1 + CF2 / (1+IRR)^2 + ... + CFn / (1+IRR)^n = 0

Calculate internal rate of return manually or with spreadsheet tools like Excel. Most people use Excel because it’s faster. If you want to know how to calculate internal rate of return in Excel, just use this function:

=IRR(A1:A5)

Let’s look at an internal rate of return calculation example:

| Year | Cash Flow ($) |

| 0 | -10,000 |

| 1 | 2,500 |

| 2 | 3,000 |

| 3 | 4,000 |

| 4 | 4,500 |

If you enter these values in Excel and use the internal rate of return function, you’ll get around 14.3%. This is your internal rate of return.

4. What Is IRR Used For?

IRR has many uses. It’s most common in capital budgeting, where businesses choose which projects to fund.

It helps them understand if a project will return more than their cost of capital or required rate of return (RRR).

Internal rate of return is also useful in real estate investment IRR calculations, where developers want to know if a property is worth buying. It’s also used by venture capitalists when they review startups.

In all these cases, internal rate of return supports investment analysis by offering a clear number to compare against risk and return expectations.

Whether it’s for long-term infrastructure, new technology, or real estate, understanding internal rate of return can lead to better project selection using internal rate of return and smarter use of resources.

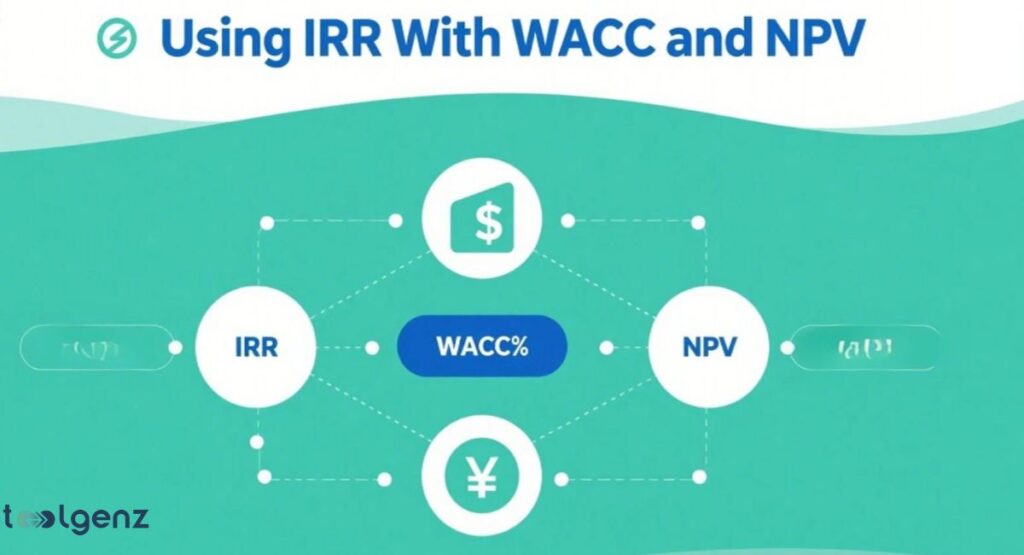

5. Using IRR With WACC and NPV

To fully understand IRR, you must look at how it works with Net Present Value (NPV) and Weighted Average Cost of Capital (WACC).

IRR is the point where NPV = 0. But to know if that IRR is good, you compare it with your WACC.

If the internal rate of return is higher than the WACC, the investment adds value and is likely worth pursuing. But if it’s lower, it may not meet your financial goals.

This comparison is crucial when you’re deciding whether an investment really adds value or just looks good on paper.

If internal rate of return is higher than WACC, it’s a good investment. If it’s lower, you may lose money. This is called the IRR decision rule. It’s a common step in investment analysis using internal rate of return.

| Metric | Description |

| IRR | Rate where NPV = 0 |

| WACC | Average cost of funds used in the project |

| NPV | Present value of future cash flows minus investment |

6. IRR vs. Other Investment Metrics

Compound Annual Growth Rate (CAGR)

CAGR tells you the average yearly growth rate over time. It doesn’t account for cash flow timing like internal rate of return does. That’s why IRR vs CAGR annual return shows different results for uneven cash flows.

While CAGR is useful for showing overall growth, internal rate of return is especially useful when your cash flow isn’t steady — it shows how your returns really stack up over time.

This makes internal rate of return more reliable for complex investment analysis using IRR, especially when evaluating real-world projects or business investment decisions.

Return on Investment (ROI)

ROI is a simple ratio of gain vs. cost. But IRR vs ROI comparison shows that ROI doesn’t consider time value of money.

That means ROI can be misleading for long-term projects or those with irregular cash flow. internal rate of return, on the other hand, includes the timing of returns, offering a deeper view of profitability.

For accurate financial analysis and smarter investment appraisal, internal rate of return is often preferred in capital budgeting and corporate finance.

Cash-on-Cash Return

This tells you how much cash you get back each year compared to the cash you invested. internal rate of return vs cash-on-cash return matters most in real estate.

| Metric | Time Value | Cash Flow Timing | Complexity |

| IRR | Yes | Yes | Medium |

| ROI | No | No | Easy |

| CAGR | Yes | No | Easy |

| Cash-on-Cash | No | Yes | Easy |

7. What Is a Good Internal Rate of Return?

A good IRR depends on the industry and your hurdle rate. In real estate, anything over 12–15% is often considered solid.

For startups, investors may expect 25% or more because of the risk.

When asking what is a good internal rate of return, you must compare it to your cost of capital. If your internal rate of return is below your required rate of return (RRR), you should avoid the project.

That’s why many investors follow a simple rule — only go ahead if the internal rate of return is higher than your target return.

Understanding this helps in better capital allocation and supports more confident business investment decisions.

8. Limitations and Pitfalls of IRR

While IRR is useful, it has flaws. First, if your project has irregular cash flows, you may get more than one internal rate of return. This can get confusing — it’s known as the ‘multiple internal rate of return’ issue.

Another issue is that IRR assumes reinvestment rate equals the internal rate of return itself.

This is not always realistic. Internal rate of return also ignores project size, which can mislead when comparing a $10M project to a $100K one.

These issues highlight the importance of using IRR alongside other tools like Net Present Value (NPV), profitability index, and discounted cash flow (DCF) in project selection using IRR.

A balanced financial analysis provides more accurate investment decisions.

9. How to Use internal rate of return for Smart Investing

To make smarter decisions, use internal rate of return along with other tools like NPV, profitability index, and payback period.

Don’t rely on internal rate of return alone. Also, make sure your cash flow projections for IRR are realistic.

This is especially helpful in project selection using IRR. If you manage multiple investment options, IRR shows which project gives the best return, but always consider size, risk, and time.

Incorporating internal rate of return into your financial planning gives a clearer view of potential returns, especially when used with capital budgeting and investment appraisal methods.

This holistic approach leads to better long-term results in both business and personal investments.

10. Final Thoughts: Should You Rely on IRR Alone?

IRR is a great tool for using Internal rate of return in corporate finance and investment appraisal. But it’s not perfect. Use it with other metrics for a full view of your options.

The key to good financial planning is balance. With a strong grasp on IRR, plus tools like discounted cash flow (DCF) and NPV, you’ll be better prepared to grow your money smartly.

“Internal rate of return isn’t just a number — it’s a tool that, when used right, can help you make smarter, more confident investment choices.”

By combining Internal rate of return with real-world project evaluation and reliable financial analysis, investors can unlock smarter capital allocation strategies.

In the long run, understanding Internal rate of return leads to better investment return and more confident business decisions.

FAQs

What does a 20% Internal rate of return mean?

A 20% Internal rate of return means the investment is expected to earn a 20% return per year over its life, based on projected cash flows.

What is Internal rate of return in simple terms?

Internal rate of return is the interest rate at which an investment breaks even, making the net present value (NPV) of all cash flows equal to zero.

Is 7% a good Internal rate of return?

A 7% Internal rate of return may be good for low-risk investments like bonds but might be too low for high-risk projects or startups.

What does a 12% Internal rate of return mean?

A 12% Internal rate of return means the investment is projected to generate a 12% annual return, which is often seen as solid, especially in real estate.

Is 30% Internal rate of return too high?

A 30% Internal rate of return can be excellent but may indicate higher risk or overly optimistic cash flow projections.