How to Build Credit Without a Credit Card (2025 Guide)

Having good credit matters more than ever these days, but many people wonder how to build credit without a credit card. In 2025, with rising credit card debt and tighter approval requirements, more Americans are looking for safer, smarter options.

Whether you’re just starting out, recovering from past mistakes, or simply avoiding plastic, this guide reveals effective ways to build credit without using credit cards.

You’ll discover how tools like Experian Boost, rent reporting services, and installment loans can help establish or improve your credit.

Mastering responsible credit habits today can open doors to better financial opportunities tomorrow—all without swiping a single card.

These strategies can help you improve your credit profile and feel more in control of your finances. Let’s explore the best ways to build solid credit—on your terms.

Why Building Credit Without a Credit Card Matters

Credit cards are common, but they’re not always the best tool. Some people avoid credit cards due to high interest rates, overspending, or past debt.

Others simply can’t qualify. Still, everyone needs credit to rent a home, get a job, or qualify for loans. That’s why building credit without using credit cards has become a smart and popular choice.

Finding ways to improve credit score without a credit card gives you more control and less risk. It’s also ideal for students, new immigrants, or anyone trying to build trust with lenders.

In this guide, you’ll learn about methods like using a credit builder loan, paying installment loans, using Experian Boost, and how to get credit for rent payments.

These modern credit-building options are not only practical but widely accessible. With a little consistency and smart planning, you can boost your credit score and gain financial freedom—no credit card required.

Factors That Impact Your Credit Score

To understand what affects my credit score, it helps to look at how the system works. There are five main credit score factors: payment history, credit utilization, length of credit history, types of credit, and recent activity. Each one plays a role in how your score is calculated.

Payment history makes up the biggest chunk. That means lenders want to see that you pay bills on time. Credit utilization is next. If you use too much of your available credit, even on a secured credit card, it can hurt your score.

The age of your accounts also matters, along with the types of loans you have, such as revolving credit vs installment credit. Finally, every time you apply for credit, a credit inquiry is added to your record. Too many of these can hurt your score.

Knowing what affects your credit score can help you build better financial habits over time. By focusing on the right areas—like making on-time payments and limiting credit inquiries—you can steadily boost your score over time.

7 Ways to Build Credit Without a Credit Card

There are many ways to build credit without using credit cards. First, you can become an authorized user on someone else’s account. If they pay responsibly, it helps your credit too.

Next, you can apply for a credit builder loan. This small loan reports payments to the credit bureaus (Equifax, Experian, TransUnion).

Another good method is to make regular payments on installment loans like student loans and credit or car loans. You can also sign up for rent reporting services that add your rent to your credit report.

One of the most popular tools now is Experian Boost, which lets you add utility payments and subscriptions to your credit report. Lastly, if you do want a card, try a secured credit card for bad credit that requires a deposit.

These options help you grow your credit history—even if you skip the traditional credit card route. The key is to stay consistent, pay bills on time, and monitor your credit regularly to track progress. You can explore additional methods in Experian’s advice on building credit without a card.

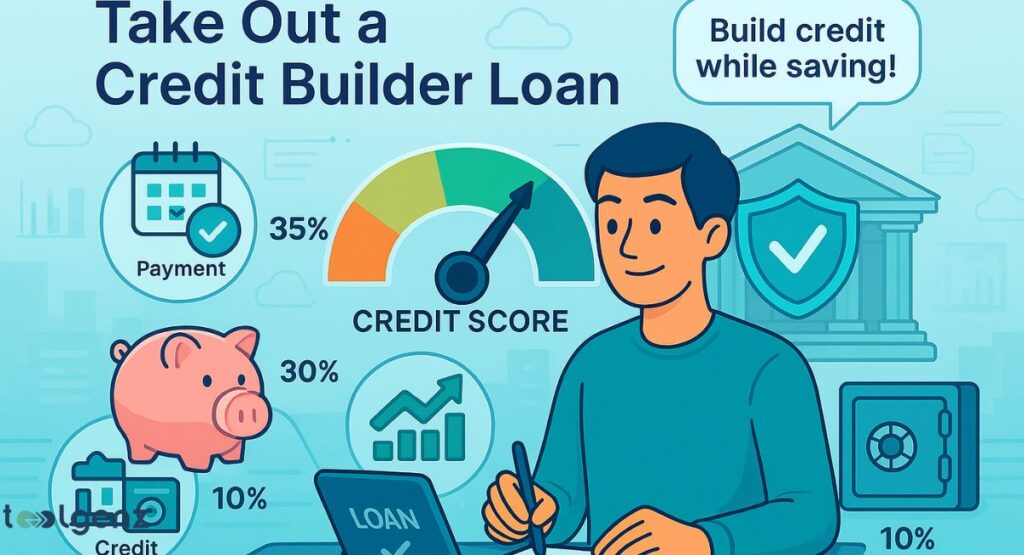

Take Out a Credit Builder Loan

A credit builder loan is one of the best credit builder loan options out there. You borrow a small amount, but instead of getting the money right away, the lender holds it in a secure account.

You make monthly payments, and once the loan is paid off, you get the funds. These loans are perfect for building credit as a student or young adult. They usually range from $300 to $1,000. Banks, credit unions, and online lenders offer them.

They’re safe because they report every on-time payment to the credit bureaus (Equifax, Experian, TransUnion), helping you create a solid credit history.

You’ll improve your score and build up some savings at the same time. If you’re looking to improve credit score without a credit card, a credit builder loan is a smart and low-risk starting point.

Pay Installment Loans on Time

If you have installment loans like car loans, student loans, or personal loans, paying on time is critical. This shows lenders you can be trusted. In fact, your payment history is one of the biggest credit score factors.

The auto loan credit impact is strong because lenders report every month. If you’re late, your score drops. If you’re early or on time, your score goes up. So, keep up with your payments, and your score will grow steadily.

Keeping up with installment loan payments also shows lenders you can handle different types of credit. which helps strengthen your credit profile. These small habits go a long way in building lasting financial trust.

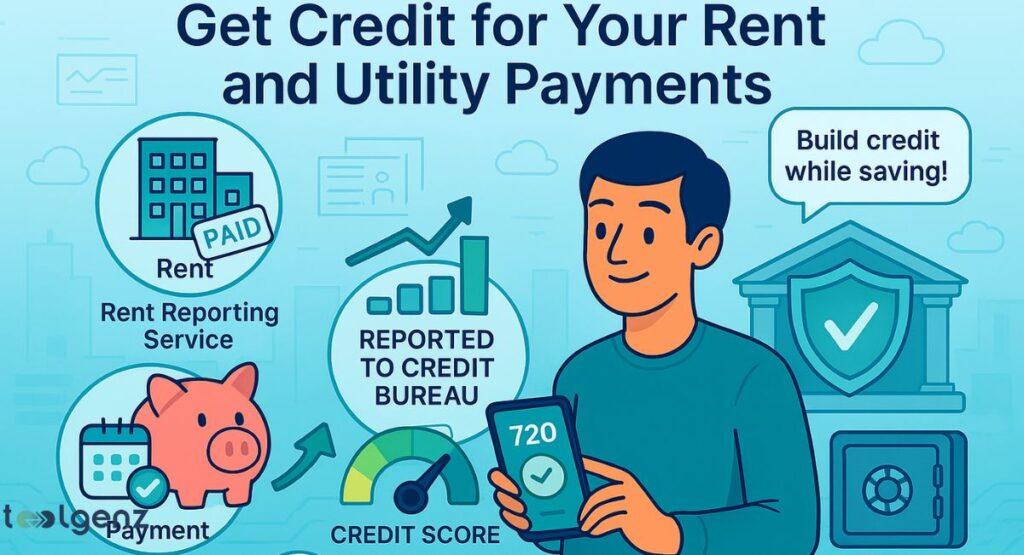

Get Credit for Your Rent and Utility Payments

Yes, does rent payment affect credit score? It can if it’s reported. Services like rent reporting services let landlords or tenants send payment data to credit bureaus. That way, your on-time payments help your credit.

If your landlord doesn’t offer this, you can sign up yourself. How to report rent to credit bureaus? Use companies like Rental Kharma, Esusu, or RentReporters.

These services are easy to set up and cost a small fee. Utility bills can also help with your credit. Just keep reading.

When used consistently, rent reporting can boost your credit history and show lenders a reliable payment pattern. It’s a smart way to build credit—without ever needing a card.

Use Experian Boost™ to Get Credit for Bills

Experian Boost is a helpful way to raise your score, especially if you’re just starting out in 2025.

This free tool adds your utility payments, streaming subscriptions, and phone bills to your credit file. That means things like Netflix, Hulu, and electric bills now count toward your score.

This is especially helpful if you don’t have loans or credit cards. Even one or two good on-time payments can raise your score. According to Experian, many people see their FICO score go up by 10 to 13 points after using Boost.

It’s one of the fastest and easiest ways to get credit for bills you’re already paying. If you’re looking to improve credit score without a credit card, this tool is a smart first step.

Check Your Credit Scores and Reports Regularly

You can’t improve what you don’t track. Knowing how to check credit score for free is key to building strong credit. Sites like AnnualCreditReport.com, Experian, and Credit Karma offer free tools for this.

Also look for credit report errors. These mistakes can hurt your score unfairly. If you find any, you can dispute them. Staying on top of your reports is one of the best credit report monitoring tips and ensures your hard work is paying off.

By checking regularly, you’ll catch any mistakes early and better understand what’s shaping your credit. By checking in often, you stay in control of your financial progress.

Knowing how to check credit score for free is key to building strong credit. For a deeper understanding, read our credit score guide for 2025.

How to Avoid Hurting Your Credit While You Build It

Even if you’re trying to grow your credit, small mistakes can cause harm. For example, missing even one bill can cause serious damage. That’s why it’s vital to pay bills on time, no matter how small.

Another common mistake is applying for too much credit at once. The impact of credit inquiries on credit score is real. Space out applications to avoid a dip. If you have high-interest debt, consider debt consolidation to make repayment easier.

Building credit takes consistency and patience. Avoid closing old accounts too soon, keep your credit utilization low, and focus on responsible credit habits to protect your progress.

Final Tips on Building Credit Without a Credit Card

To wrap things up, remember this: responsible credit habits are the heart of every good score. Whether it’s a credit builder loan, rent reporting services, or Experian Boost, every step counts. Choose the tools that work for you and stick with them.

It also helps to track your score, stay informed, and learn from the best credit tips for beginners. When used smartly, these tools are just as powerful as credit cards.

The path to credit success doesn’t need plastic—just patience, planning, and a little effort every month.

With time and consistency, you’ll build strong credit without the risks that often come with credit cards—and unlock better financial opportunities in the process.

FAQs

Can I build a credit score without a credit card?

Yes, you can build credit using tools like credit builder loans, rent reporting services, or Experian Boost without ever needing a credit card.

What is the fastest way to build credit if you have no credit?

The fastest way is to use a credit builder loan, make on-time payments, and report rent or utility bills through Experian Boost.

How do I build my credit score if I can’t get a credit card?

You can become an authorized user, pay off installment loans, or use services that report your rent and utility payments to the credit bureaus.

How to get a 700 credit score in 30 days?

While rare, you might boost your score quickly by using Experian Boost, paying down debt, and fixing any credit report errors.

How do I build credit if nobody will give me a credit card?

Start with a secured credit card for bad credit, a credit builder loan, or use rent reporting services to establish credit history.